LTC Price Prediction: Technical Breakout and Institutional Momentum Signal Upside Potential

#LTC

- Technical Breakout Potential - LTC trading above 20-day MA with converging MACD suggests bullish momentum building

- Institutional Catalyst - Spot ETF filing and traditional finance integration creating fundamental support

- Market Positioning - Positioned near Bollinger upper band with reduced volatility indicating potential significant move

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge Above Key Moving Average

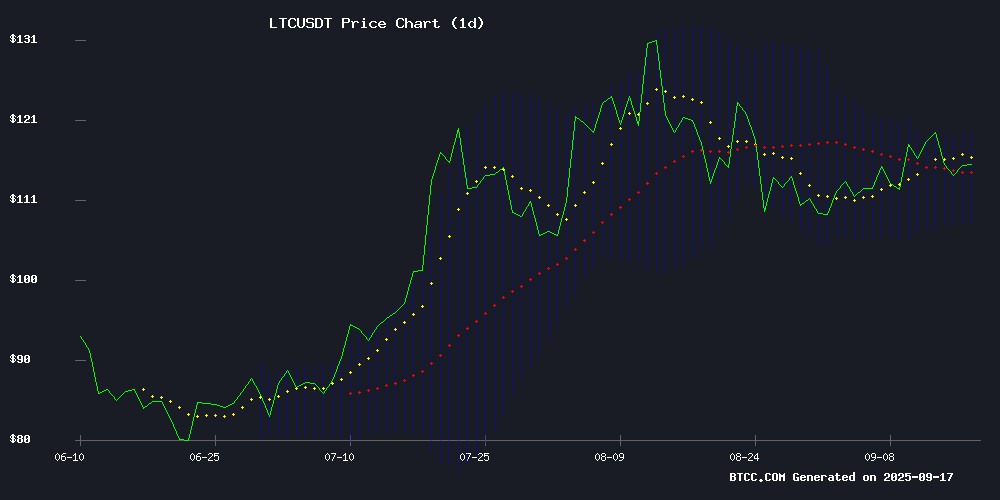

Litecoin is currently trading at $115.21, positioned above its 20-day moving average of $113.39, indicating potential bullish momentum. The MACD reading of -1.97 remains in negative territory but shows signs of convergence with the signal line at -0.05, suggesting weakening downward pressure. Bollinger Bands analysis reveals LTC trading NEAR the upper band at $119.14, with the middle band at $113.39 providing support. According to BTCC financial analyst Olivia, 'The technical setup suggests LTC could test resistance near $119 if it maintains its position above the 20-day MA. The narrowing Bollinger Bands indicate decreasing volatility, often preceding significant price movements.'

Institutional Adoption and ETF Developments Boost LTC Sentiment

Recent institutional developments are creating positive momentum for Litecoin. Canary Capital's filing for a Spot Litecoin ETF with a competitive 0.95% fee signals growing institutional interest, while Santander's Openbank integrating Cardano demonstrates broader crypto acceptance that benefits the entire sector. BTCC financial analyst Olivia notes, 'The ETF proposal specifically for Litecoin, combined with major traditional financial institutions embracing cryptocurrency services, creates a favorable environment for LTC's price appreciation. These developments typically precede increased institutional inflows.' The broader market sentiment remains bullish ahead of the Fed rate decision, with institutional investors maintaining positive positions across digital assets.

Factors Influencing LTC's Price

Santander's Openbank Integrates Cardano, Signaling Institutional Adoption Amid Bullish Technical Setup

Santander's digital banking arm Openbank has integrated Cardano (ADA) into its platform, granting 2 million European customers direct access to the cryptocurrency. The move, compliant with Europe's MiCA regulations, begins with German users and will expand to Spanish markets in coming weeks.

ADA trades at $0.94 following a 12.83% weekly gain, testing the psychologically significant $1.00 resistance level. Technical indicators suggest growing momentum: the TD Sequential flashes a buy signal while the RSI stabilizes at 47, indicating waning selling pressure. A completed cup-and-handle formation points to potential upside targets near $5.00.

Derivative markets reflect renewed interest, with ADA open interest reaching July highs. The token's volatility profile mirrors March conditions when ADA posted a 72% single-session rally. Institutional adoption through traditional banking channels could provide the catalyst for another significant move.

Tuttle Capital's ETF Proposals Spark Altcoin Rally

Tuttle Capital has filed applications with the SEC for spot ETFs tracking Bonk, Sui, and Litecoin, triggering immediate price surges across all three assets. The September 16 submissions through ETF Opportunities Trust propose using innovative FLEX Options to provide synthetic exposure, bypassing direct crypto ownership while capturing price movements.

Market response was swift and decisive. Bonk jumped 4% to $0.0000242 within hours of the announcement, while Sui gained over 3% to reach $3.60. The reaction underscores growing institutional influence on crypto valuations, particularly through novel financial instruments that bridge traditional and digital asset markets.

These ETF structures represent a maturation point for altcoin markets. By employing customizable options contracts with variable expiration dates and strike prices, Tuttle Capital's approach offers institutional investors familiar risk management tools while maintaining crypto market exposure—a compromise that appears to resonate strongly with traders.

Tuttle Capital Files for Spot Bonk ETF Amid Growing Institutional Demand

Tuttle Capital, a $3.6 billion asset manager, has filed with the SEC for a spot Bonk Income Blast ETF, marking the second such filing after Rex Shares and Osprey Funds. The proposed fund joins parallel filings for Litecoin and Sui ETFs, signaling broadening institutional interest in memecoins.

Bonk's market dynamics appear to drive this demand. The Solana-based memecoin boasts a $1.87 billion market cap and $348 million daily trading volume, currently ranking as the second-largest memecoin behind Pudgy Penguins. BONK price rose 4% to $0.00002426 following the announcement.

The filing coincides with growing ecosystem development, including the LetsBonk.fun platform. With Q4's anticipated bull market, analysts project BONK may outperform major assets like Bitcoin, Ethereum, and Solana.

Openbank Introduces Seamless Crypto Services for German Customers

Openbank has launched a direct cryptocurrency trading service in Germany, enabling customers to buy, sell, and hold digital assets such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Polygon, and Cardano (ADA). The rollout operates under the MiCA regulatory framework, ensuring compliance and security. Expansion to Spain is anticipated in the coming weeks, signaling Openbank's broader European ambitions.

The integration of Bitcoin into Openbank's platform marks a significant milestone, allowing German clients to access BTC without relying on external exchanges or wallets. This move aligns digital assets with traditional investment products, simplifying user access under full EU regulatory oversight. The initiative reflects growing demand for secure, bank-integrated crypto services.

XRP Investors Shift to Cloud Mining for Stable Returns Amid Market Volatility

XRP's notorious price volatility and regulatory uncertainty have pushed investors toward alternative revenue streams. AIXA Miner now offers cloud mining contracts converting XRP holdings into BTC, ETH, LTC, and DOGE mining positions, promising $7,000+ daily rewards regardless of market conditions.

The platform circumvents XRP's inherent unminable nature by diversifying exposure to mineable assets. This structural shift allows holders to decouple earnings from XRP's price swings—a tactical advantage during bear markets where trading profits evaporate.

Cloud mining's appeal lies in its passivity. Unlike active trading requiring constant market monitoring, AIXA's contracts automate yield generation without hardware ownership. The $7,000 daily benchmark targets institutional-scale investors, though retail participants benefit proportionally from the same mechanism.

Canary Capital Files for SEC Approval of Spot Litecoin ETF with 0.95% Fee

Canary Capital has submitted a filing to the U.S. Securities and Exchange Commission (SEC) for a spot Litecoin ETF, proposing a 0.95% annual fee. The fund, slated to trade on Nasdaq under the ticker LTCC, aims to provide a regulated gateway for Litecoin exposure in traditional markets.

Coinbase Custody and BitGo will safeguard the ETF's Litecoin reserves, while U.S. Bancorp Fund Services will handle administrative duties. The SEC's decision is anticipated by October 2025, marking a potential milestone for Litecoin's integration into mainstream finance.

Institutional Investors Maintain Bullish Stance Ahead of Fed Rate Decision

Global fund managers overseeing $426 billion remain optimistic despite the S&P 500 hitting a record high of 6,626.99. Cash allocations stay low at 3.9%, while equity exposure reaches a seven-month peak with 28% of respondents overweight stocks. The Fed's impending rate decision on September 17 is expected to kickstart a new cycle of cuts, reducing borrowing costs.

Crowded trades persist, with 42% of managers long the Magnificent 7 and 25% favoring gold. Short positions on the dollar (14%) and crypto longs (9%) also feature prominently. Bank of America's Michael Hartnett sees room for further gains, citing diminished recession risks and tempered equity positioning.

Bitcoin Eyes $120K as DNSBTC Promotes Cloud Mining Solution

Bitcoin's bullish momentum continues as analysts project a potential surge to $116,000–$120,000 if key support levels hold. This optimistic outlook is driving interest in alternative accumulation strategies, particularly cloud mining services like DNSBTC.

The US-based platform, operational since 2020, offers contract-free mining for Bitcoin (BTC), Litecoin (LTC), and Dogecoin (DOGE) across data centers in North America and Iceland. Its infrastructure eliminates hardware barriers, appealing to both novice miners and time-constrained investors.

Market observers note that cloud mining's automated payout systems provide compounding benefits during upward price trends. DNSBTC's daily settlement feature positions it as a contender in the competitive cloud mining sector, particularly for investors seeking exposure without direct asset custody.

Top Cloud Mining Platforms for 2025 Offer Passive Crypto Earnings

Cloud mining continues to gain traction as a viable method for earning cryptocurrencies without the overhead of hardware management. Leading platforms now offer automated solutions for Bitcoin, Litecoin, and Dogecoin mining, with DNSBTC emerging as the standout provider for 2025.

The U.S.-based platform distinguishes itself through daily payouts and free mining packages, operating data centers across North America and Iceland. Its combination of transparency and reliability has positioned it as the industry leader among seven major services reviewed.

Investors increasingly prioritize platforms that deliver consistent returns without requiring technical expertise. The sector's growth reflects broader adoption of passive income strategies in digital asset markets, particularly for retail participants seeking exposure to proof-of-work cryptocurrencies.

Is LTC a good investment?

Based on current technical indicators and market developments, LTC presents a compelling investment opportunity. The price trading above the 20-day moving average combined with narrowing Bollinger Bands suggests potential upward movement. Fundamentally, the ETF filing by Canary Capital and growing institutional adoption create strong tailwinds.

| Metric | Current Value | Signal |

|---|---|---|

| Price | $115.21 | Above 20-day MA |

| 20-day MA | $113.39 | Support Level |

| Bollinger Upper | $119.14 | Near-term Resistance |

| MACD | -1.97 | Converging Bullishly |

BTCC financial analyst Olivia emphasizes that 'LTC's technical positioning alongside institutional catalysts makes it well-positioned for potential gains, though investors should monitor the $119 resistance level closely.'